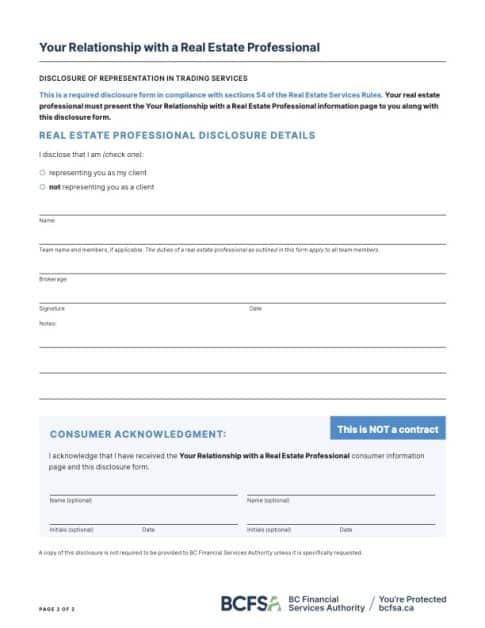

Disclosure of Representation in Trading Services

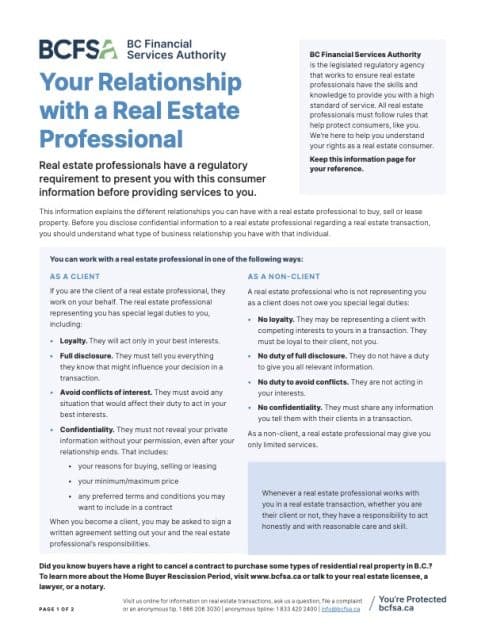

This post is about Representation and the benefit of signing the Disclosure of Representation in Trading Services (DORTS) form. In summary, by signing the DORTS form, you are binding the real estate agent to honor four legal obligations:

- Loyalty

- Avoid conflicts of interest

- Fully disclose any relevant information

- Protect your confidentiality (indefinitely)

A 5th element was added to this form on January 1, 2023. It was an explanation of the Home Buyer Rescission Period.

When Is the DORTS Form Signed?

The discussion about Representation includes an explanation of the DORTS form. The British Columbia Financial Services Authority (BCFSA) expects this discussion to happen at the beginning of the relationship, and basically with the first communication. The reason is: you should understand the agency relationship you are about to enter into. The timing also reminds the Realtor of their fiduciary obligation to you.

Seller and Listing Agent Representation

There is little merit in calling the listing agent as the agent can only tell you what is already on the datasheet. The listing agent is duty-bound not to give out any more information. That agent represents the Seller who has both signed the DORTS form. Any personal information about yourself or your real estate needs could be valuable information for a listing agent, should you write an offer. Gone are the days of calling the listing realtor for the inside scoop, who was eager to oblige with the potential of representing both the seller and the buyer in a Dual Agency arrangement. Now, that conversation can lead to an implied agency and a world of pain for the listing realtor.

Dual Agency Banned in Whistler

In June 2018, The Real Estate Council of British Columbia (RECBC) banned Dual Agency in Whistler. What does this mean for you, the Buyer? Well, it means that the listing agent can only represent the Seller, and a different agent will represent you, the Buyer. The intent of the RECBC was to provide fair representation for both parties during the negotiations and throughout the transaction.

The (RECBC) was very serious about this form. Each real estate agent is expected to email every signed copy of the DORTS to their Broker. The Broker then keeps it on file, for future audits. There are massive fines for the real estate agent and their broker who do not follow this ruling. The fines can be $250,000. Needless to say, that is a game-changer for most realtors.

BC Financial Services Authority (BCFSA)

On August 1, 2021, The RECBC and the Office of the Superintendent of Real Estate merged to create The BC Financial Services Authority (BCFSA). The BCFSA became the single regulator for BC financial services, including real estate. In essence, any other configuration of the one agent per party rule is not tolerated by the BCFSA.

Home Buyer Rescission Period (HBRP)

The Home Buyer Rescission Period was developed by the BCFSA in response to the multiple offer situations in 2020-2022. During that frenzy, buyers were writing offers with no subjects, and then regret set in. It is also known as a “cooling off period”.

DORTS Form

In summary, this is not a binding document that ties you to your agent. It actually binds the agent to you legally and honors the four duties mentioned above. The following link is a PDF version of DORTS

I am the type of real estate agent who works hard to follow the rules. The benefit of that is no repercussions for you, or for me after the completion of the transaction. That is one of my goals for a successful transaction.

If you think I would be a good fit to work with you and your family, and you are not already working with a Whistler realtor, please contact me. I look forward to hearing from you.

It’s a Good Life in Whistler!

Marion

Marion Anderson Personal Real Estate Corporation

marion@WhistlerSkiinSkiout.com (604) 938-3885